Finally! Leniency on those pesky annual notice deliveries

Current E-Delivery Rules

Historically, there has been quite a burden and expense placed upon the plan sponsor to ensure required annual notices are distributed. The rules guiding present-day delivery are based on DOL regulations from 2002. As it stands today, to be able to use electronic delivery (e-delivery), an employee has to be considered “wired at work” and use a computer/internet/email on a regular basis to do their job, or actively elect e-delivery.

New E-Delivery Rules

Recognizing that over the last 20 years, technology and the workplace has changed, the DOL published a new e-delivery safe harbor at the end of May. In it, the DOL allows a plan sponsor to distribute annual notices and required disclosures to participants via a variety of electronic and virtual channels if they initially provide a notice of internet availability (NOIA).

Prior to sending this notice, however, the plan sponsor must provide a customized, paper notice to each employee stating the plan notices have defaulted to electronic delivery and listing the email address or mobile number that will be used for delivery to that individual going forward. Then, the NOIA is sent to that address or number with a link (this is required) to the location of the documents posted on a website. These documents must remain posted for 12 months.

An additional option is to send the notice directly via email. In that case, a NOIA is not required.

Note that with these new rules, there must be a mechanism in place to alert the plan sponsor of any delivery failures.

Plan Sponsors have Options

The new rule takes effect July 27, 2020, but plan sponsors may implement sooner if they wish. Currently, these provisions are only applicable for retirement plans, but this could be expanded in the future to encompass other benefit plans as well. The new rules do not change or override the 2002 provisions; implementing e-delivery is not mandatory. Plan sponsors, however, have the option as to which rule they will rely on going forward.

What to do next

- If you haven’t heard from your recordkeeper yet on this topic, reach out to confirm how they are handling the new rules and what may be needed of you, as the plan sponsor.

- Consider your workforce: Do your employees have email addresses? Mobile phones? Easy access to computers? How will you ensure you have collected the correct email or phone number for all employees? How will you track delivery failure?

- Be careful of the texting delivery option. How will you ensure all employee phones are properly equipped to receive text messages?

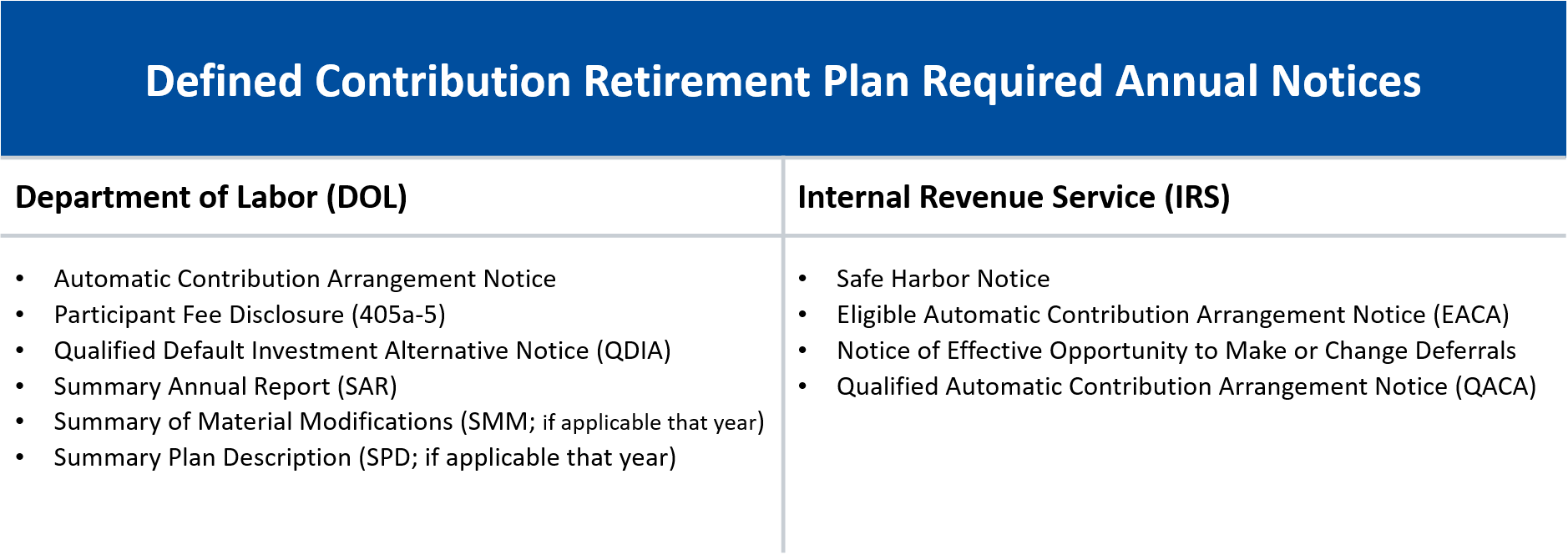

- Remember: This covers DOL notices only: summary plan documents, annual fee disclosures, etc. It does not include IRS required notices such as automatic contribution arrangement notices. See the table for a review of required annual notices from each regulatory body.

At Francis Investment Counsel, we help plan sponsors keep track of the dynamic regulations affecting their retirement plans. If you need expert consultation for your retirement plan, reach out to one of our team members or fill out the form below for assistance.

These are most common. Not all notices are applicable to every plan. Reach out to your service providers to confirm your required notices. For additional details on Department of Labor notices, visit the DOL’s website. For additional details on Internal Revenue Service notices, visit the IRS’ website.

Tags: required annual notices, electronic delivery, e-delivery, Department of Labor, DOL