Guide to Retirement Plan Fees

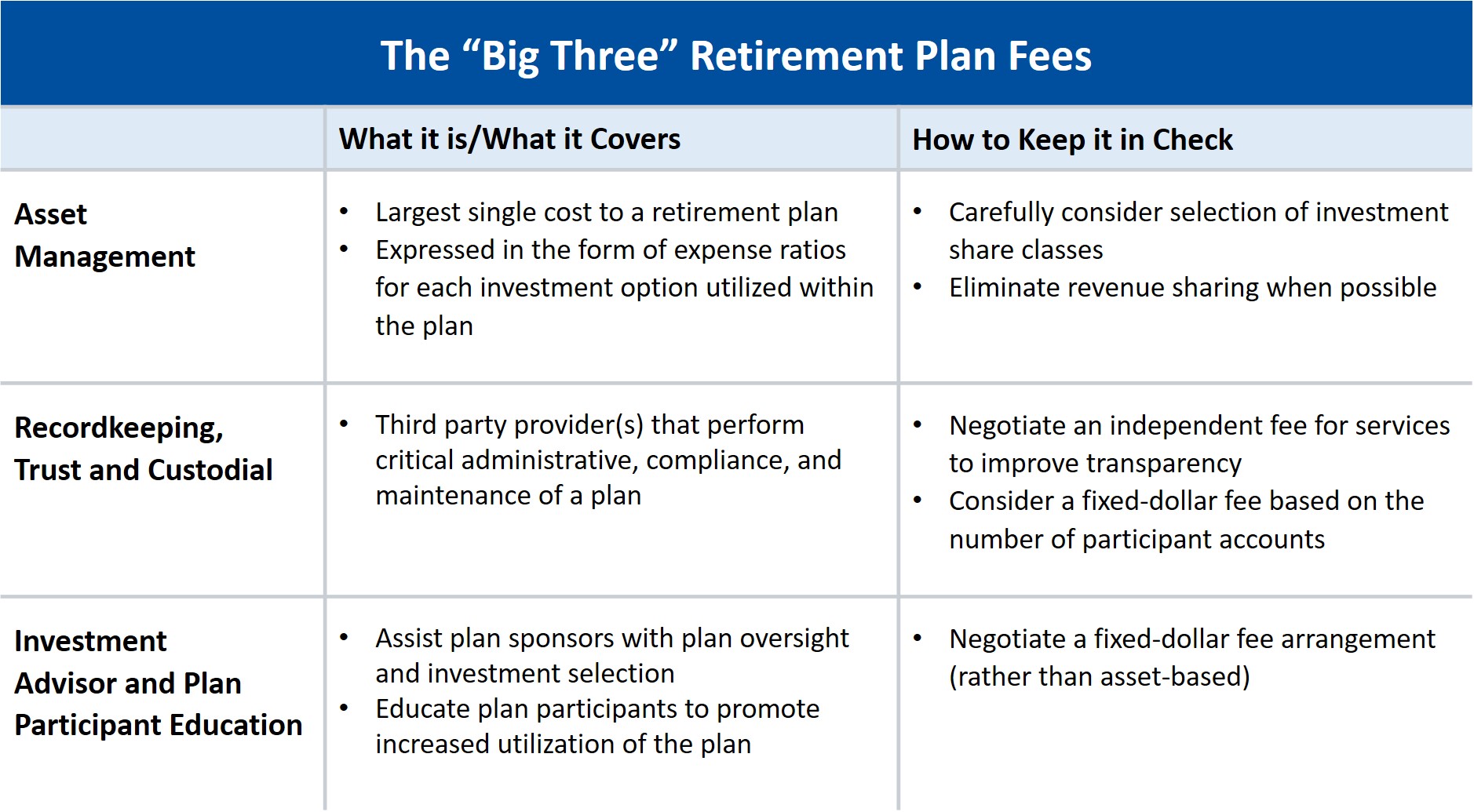

Part 1: The “Big Three” Retirement Plan Fees

What costs are included in a retirement plan?

Participant directed retirement plans come with a number of operational costs including plan recordkeeping, trust and custodial services, plan audit, legal counsel, investment advisory services, and plan participant education and advice services. That’s a lot to keep track!

Our Guide to Retirement Plan Fees outlines how plan sponsors can go about managing these costs. It also provides strategies for allocating costs to plan participants. But the first step in managing costs is identifying and understanding them. Here we address the three major cost components in a participant directed retirement plan and how to best keep these costs in check.

1) Asset Management

Asset management is the largest single cost to your retirement plan and, therefore, your plan’s participants. Asset management is expressed in the form of expense ratios. Each investment you select for your plan’s investment menu has a stated expense ratio.

What is often not clear regarding fund expense ratios is that they may include more than the fees paid to the asset management firm. This “more” refers to something called revenue sharing (12b-1 fees). Revenue sharing is in addition to the investment manager’s fee and is used to compensate other plan service providers such as your recordkeeper or advisor.

Because revenue sharing is included in (rather than separated from) the fund’s stated expense ratio, it represents a concealed cost. Additionally, because revenue sharing is asset based, it grows as the plan’s assets increase. This translates to automatic pay raises for all providers compensated through revenue sharing, all while hidden from plan participants.

How to Keep Asset Management In Check

As a plan sponsor, you control asset management costs based on the investment share classes you select. Investment managers have a wide selection of share classes from which to choose and each one will impact the plan’s cost structures differently. We advocate plan sponsors seek the lowest possible cost shares for which your plan will qualify, and when possible, eliminate share classes with revenue sharing built into their pricing. By doing so, you will improve transparency and obtain greater control over the plan’s overall cost structure.

If you are not able to eliminate all revenue sharing, consider building rebates into your participant cost allocation methodology. We detail this further in Part Three of our Guide to Retirement Plan Fees.

2) Recordkeeping, Trust and Custodial

The plan’s recordkeeper performs a host of critical daily administrative functions for the plan, including maintaining the individual participant accounts, providing plan documents, and performing compliance testing.

Your plan may pay separate fees for trust and/or custodial services. In many cases, however, these services are bundled with the recordkeeping and the costs are included in the recordkeeper’s fee.

How to Keep Recordkeeping Fees In Check

Historically, recordkeepers’ compensation was derived from a combination of asset management fees, revenue sharing, and direct participant charges for transactions such as loans or distributions. Consequently, much of their compensation lacked transparency.

Eliminating revenue sharing from the investment options within the plan will require you to negotiate an independent fee for the recordkeeping and trust/custodial services. It’s often best to separate these fees from the plan’s assets. Consider a fixed-dollar fee based on the number of participant accounts within the plan. This fee arrangement, a per participant fee, will only vary as the number of plan participants changes, aligning costs more closely to the services provided.

When discussing the fee arrangement, inquire about other sources of revenue your recordkeeping partner may receive based on your plan. Additional compensation could include shareholder servicing fees (negotiated between the recordkeeper and investment managers) and platform or shelf-space fees (for including specific investment managers within their platform). As a plan sponsor, you should be aware of any direct or indirect revenue created by your plan.

3) Investment Advisor and Plan Participant Financial Education

Retirement plan investment advisors help plan sponsors with the plan oversight process. The advisor assists the plan sponsor with the selection and monitoring of investments offered in the plan. Additionally, the advisor, when serving as a fiduciary, shares some of the risks associated with offering an ERISA plan.

Financial education to plan participants ensures they are well-positioned to maximize the retirement plan. Oftentimes advisors are utilized in this role for plan sponsors, providing financial education about the plan and assisting participants with decisions about investments, contributions, and distributions.

How to Keep Advisor Fees In Check

Similar to recordkeepers, advisors were often compensated via the annual stream of revenue sharing generated by the plan’s assets. As plan assets rose, so did the advisor’s compensation.

Now, more commonly, advisor fees are kept in check through fixed-dollar fee arrangements. Instead of automatic pay raises, advisor compensation is leveled. If your advisory services do not have this fixed structure, now is the time to renegotiate or go to market.

What to do next

Understanding the major cost components of your retirement plan is a first and important step toward clearly defined retirement plan fees. As your plan oversight group reviews these major cost components, consider the following:

- Are we utilizing the optimal share class for each of the investment options offered in our plan?

- Do we understand the amounts and the distribution of the revenue sharing dollars generated within our plan?

- How is our recordkeeper being compensated? Do we clearly understand the amount of their annual compensation and is their compensation appropriate?

- How is our investment advisor compensated? Can we clearly delineate their compensation on an annual basis?

As an ERISA plan fiduciary, your responsibility is to demonstrate the plan’s fees are reasonable and that a prudent process for monitoring these fees is in place. The team of experts at Francis Investment Counsel is here to help your oversight group understand and accurately interpret the fees you are paying. Connect with one of our team members directly or fill out the form below for assistance.

Access our complete Guide to Retirement Plan Fees.

Tags: retirement plan fees, plan costs, retirement plan expenses, cost allocation